ROI Comparison: Microbebio Organic Fertilizer Factory in Dominican Republic vs. Houston, Texas

This analysis compares the return on investment (ROI) for constructing a $25 million organic fertilizer factory with microbial and mycorrhizal culture labs in the Dominican Republic (DR) versus Houston, Texas. Both locations leverage poultry manure availability, but differences in labor costs, land prices, market access, and operational expenses impact ROI. The Houston facility achieves ROI in ~5 years, while the DR facility achieves ROI in ~4.5 years due to lower costs, though Houston offers stronger market potential and infrastructure. A 20% contingency is included in all financial projections.

Project Overview

- Facility: 50,000-square-foot factory producing 20,000 metric tons/year of organic fertilizer with proprietary microbes (e.g., Bacillus, Rhizobium) and mycorrhizae (e.g., Glomus species).

- Raw Material: Poultry manure, abundant in both regions (DR: ~0.8M tons/year; Texas: ~1.2M tons/year).

- Objectives: Compare CapEx, OpEx, revenue, and ROI to determine the optimal location.

Location-Specific Factors

Dominican Republic

- Advantages:

- Lower labor costs (~$15,000/year avg. salary vs. $55,000 in Houston).

- Cheaper land (~$0.5M for 10 acres vs. $2M in Houston).

- Proximity to Caribbean/Latin American markets for export.

- Government incentives (e.g., tax exemptions under Law 158-01 for agro-industrial projects).

- Challenges:

- Limited domestic market (DR agriculture: ~1.2M acres vs. Texas: 126M acres).

- Higher import costs for equipment and lab materials.

- Less developed infrastructure (e.g., ports, roads) increases logistics costs.

- Regulatory complexity for organic certification in export markets.

Houston, Texas

- Advantages:

- Large domestic market (Texas: 680,000 farms) and port access for exports.

- Robust infrastructure (roads, utilities, skilled labor).

- Proximity to research institutions (e.g., Texas A&M) for R&D collaboration.

- Abundant poultry manure supply (~1.2M tons/year).

- Challenges:

- Higher labor and land costs.

- Competitive market requires aggressive marketing to differentiate.

Financial Projections

Capital Expenditure (CapEx)

Total CapEx: $25M for both locations (including 20% contingency).

| Item | DR ($M) | Houston ($M) | Notes |

| Land Acquisition | 0.5 | 2.0 | DR: Cheaper industrial land; Houston: Higher costs in industrial zone. |

| Facility Construction | 8.5 | 8.0 | DR: Slightly higher due to import duties on materials. |

| Equipment | 6.5 | 6.0 | DR: Import tariffs increase costs. |

| Lab Setup | 3.0 | 3.0 | Identical for microbial/mycorrhizal labs. |

| Infrastructure | 1.0 | 1.0 | Utilities, waste systems similar. |

| Subtotal | 19.5 | 20.0 | |

| Contingency (20%) | 5.5 | 5.0 | DR: Higher contingency for import/logistics risks. |

| Total | 25.0 | 25.0 |

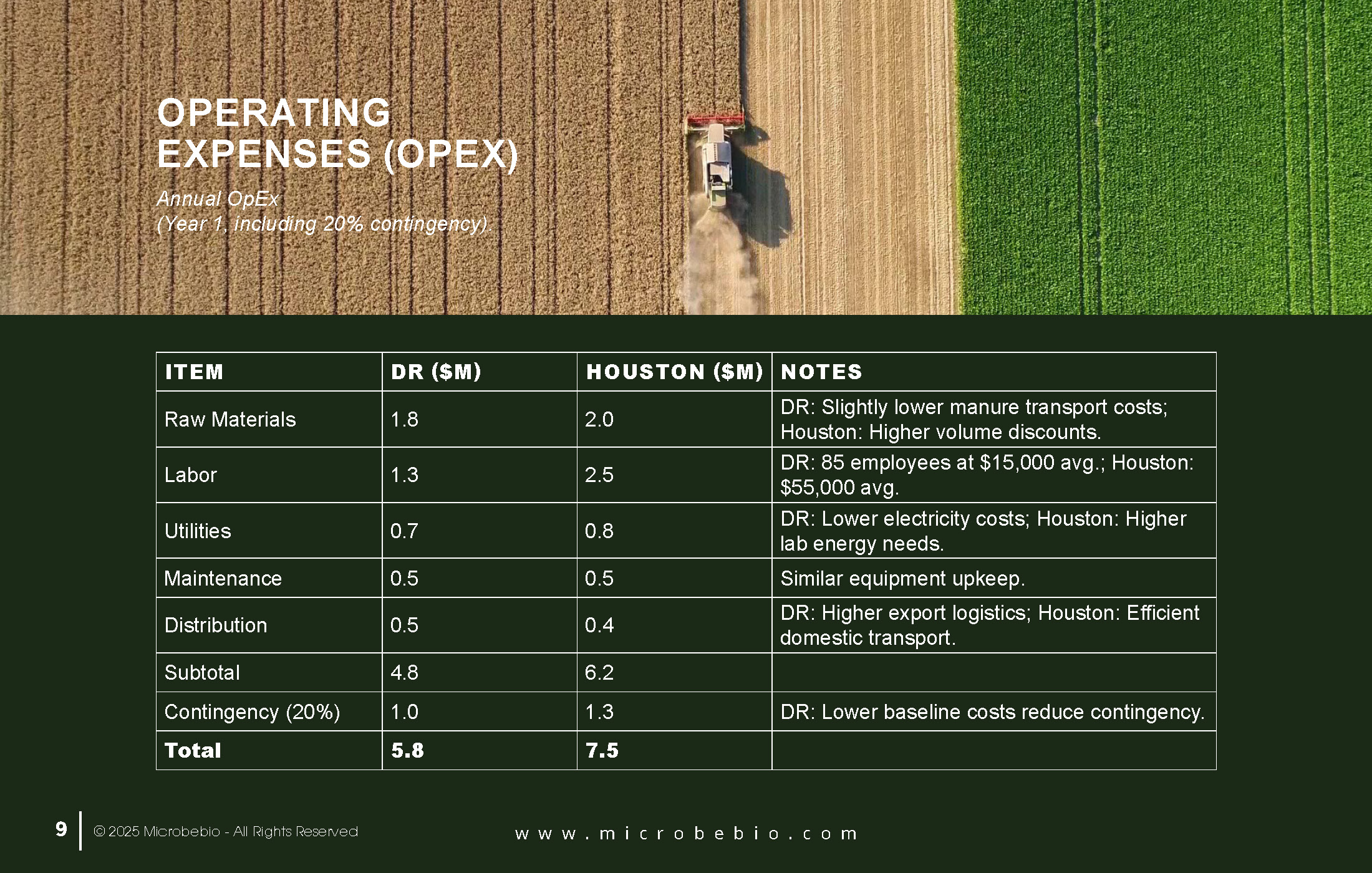

Operating Expenses (OpEx)

Annual OpEx (Year 1, including 20% contingency).

| Item | DR ($M) | Houston ($M) | Notes |

| Raw Materials | 1.8 | 2.0 | DR: Slightly lower manure transport costs; Houston: Higher volume discounts. |

| Labor | 1.3 | 2.5 | DR: 85 employees at $15,000 avg.; Houston: $55,000 avg. |

| Utilities | 0.7 | 0.8 | DR: Lower electricity costs; Houston: Higher lab energy needs. |

| Maintenance | 0.5 | 0.5 | Similar equipment upkeep. |

| Distribution | 0.5 | 0.4 | DR: Higher export logistics; Houston: Efficient domestic transport. |

| Subtotal | 4.8 | 6.2 | |

| Contingency (20%) | 1.0 | 1.3 | DR: Lower baseline costs reduce contingency. |

| Total | 5.8 | 7.5 |

Revenue Projections

- Production: 20,000 metric tons/year for both.

- Selling Price:

- DR: $450/ton (lower for regional markets, export focus).

- Houston: $500/ton (premium pricing in U.S. market).

- Annual Revenue:

- DR: 20,000 × $450 = $9,000,000.

- Houston: 20,000 × $500 = $10,000,000.

- Growth: 5% annually for both, driven by market expansion.

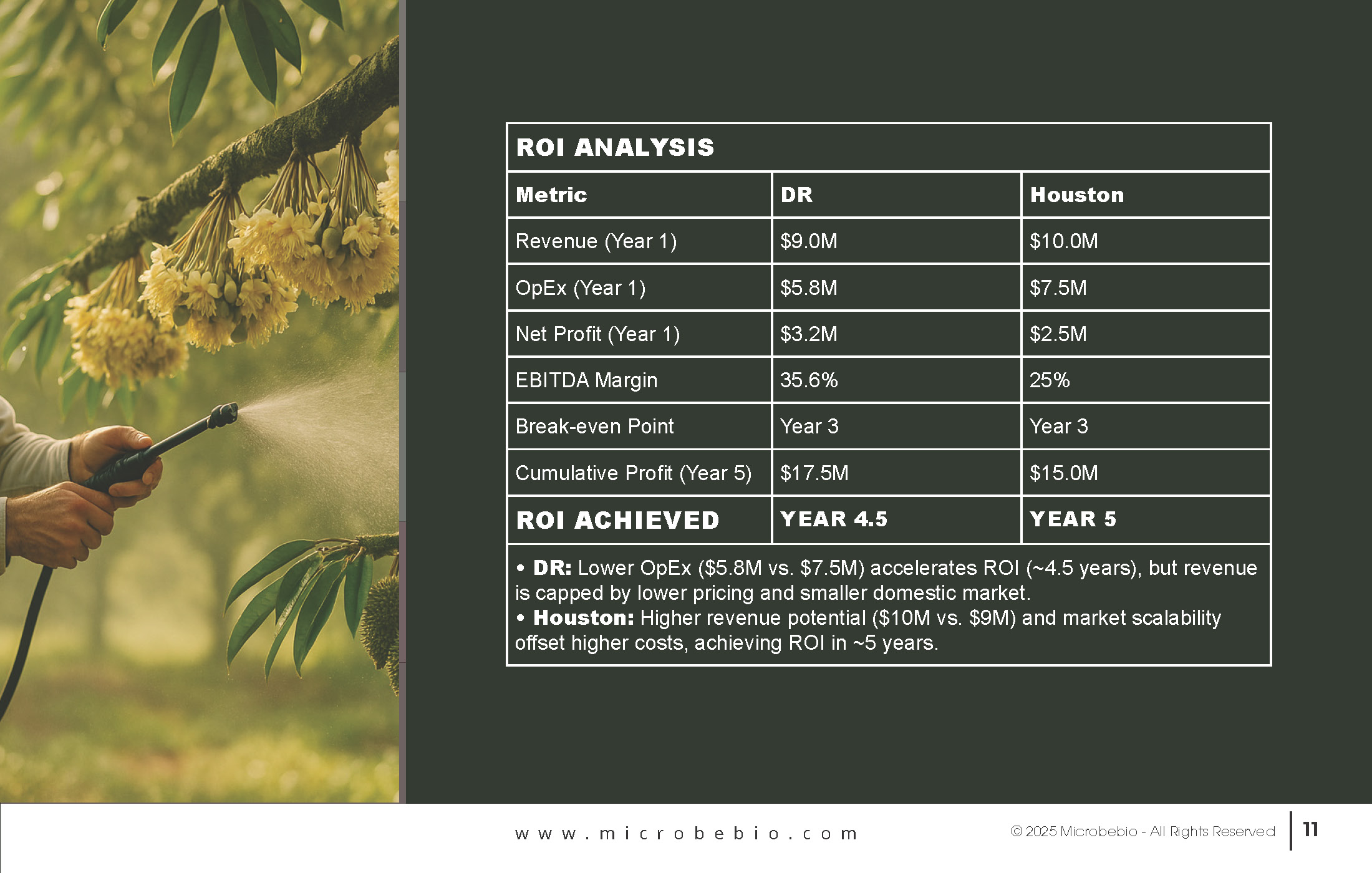

ROI Analysis

| Metric | DR | Houston |

| Revenue (Year 1) | $9.0M | $10.0M |

| OpEx (Year 1) | $5.8M | $7.5M |

| Net Profit (Year 1) | $3.2M | $2.5M |

| EBITDA Margin | 35.6% | 25% |

| Break-even Point | Year 3 | Year 3 |

| Cumulative Profit (Year 5) | $17.5M | $15.0M |

| ROI Achieved | Year 4.5 | Year 5 |

- DR: Lower OpEx ($5.8M vs. $7.5M) accelerates ROI (~4.5 years), but revenue is capped by lower pricing and smaller domestic market.

- Houston: Higher revenue potential ($10M vs. $9M) and market scalability offset higher costs, achieving ROI in ~5 years.

Job Creation

- DR: 85 direct jobs (avg. salary $15,000), ~150 indirect jobs. Economic impact: $1.3M in wages.

- Houston: 85 direct jobs (avg. salary $55,000), ~200 indirect jobs. Economic impact: $4.7M in wages.

- Comparison: Houston generates greater economic impact due to higher wages, but DR supports local employment in a developing economy.

Poultry Manure Availability

- DR: ~0.8M tons/year, sufficient for 100,000 tons input needs. Cost: ~$15/ton due to shorter transport distances.

- Houston: ~1.2M tons/year, ample supply. Cost: ~$20/ton due to larger regional logistics.

- Comparison: Both locations have sufficient supply; DR’s lower cost provides marginal OpEx advantage.

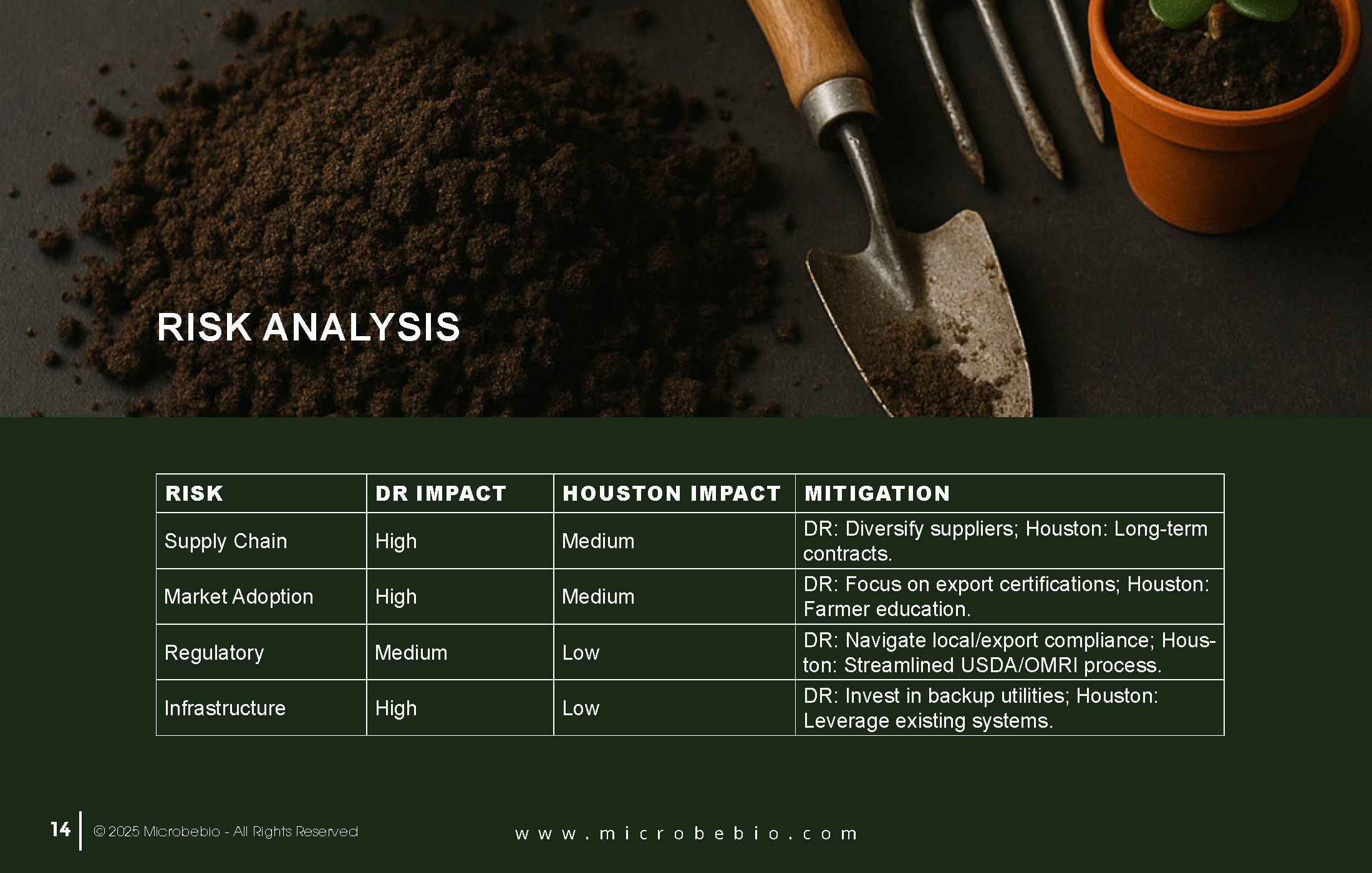

Risk Analysis

| Risk | DR Impact | Houston Impact | Mitigation |

| Supply Chain | High | Medium | DR: Diversify suppliers; Houston: Long-term contracts. |

| Market Adoption | High | Medium | DR: Focus on export certifications; Houston: Farmer education. |

| Regulatory | Medium | Low | DR: Navigate local/export compliance; Houston: Streamlined USDA/OMRI process. |

| Infrastructure | High | Low | DR: Invest in backup utilities; Houston: Leverage existing systems. |

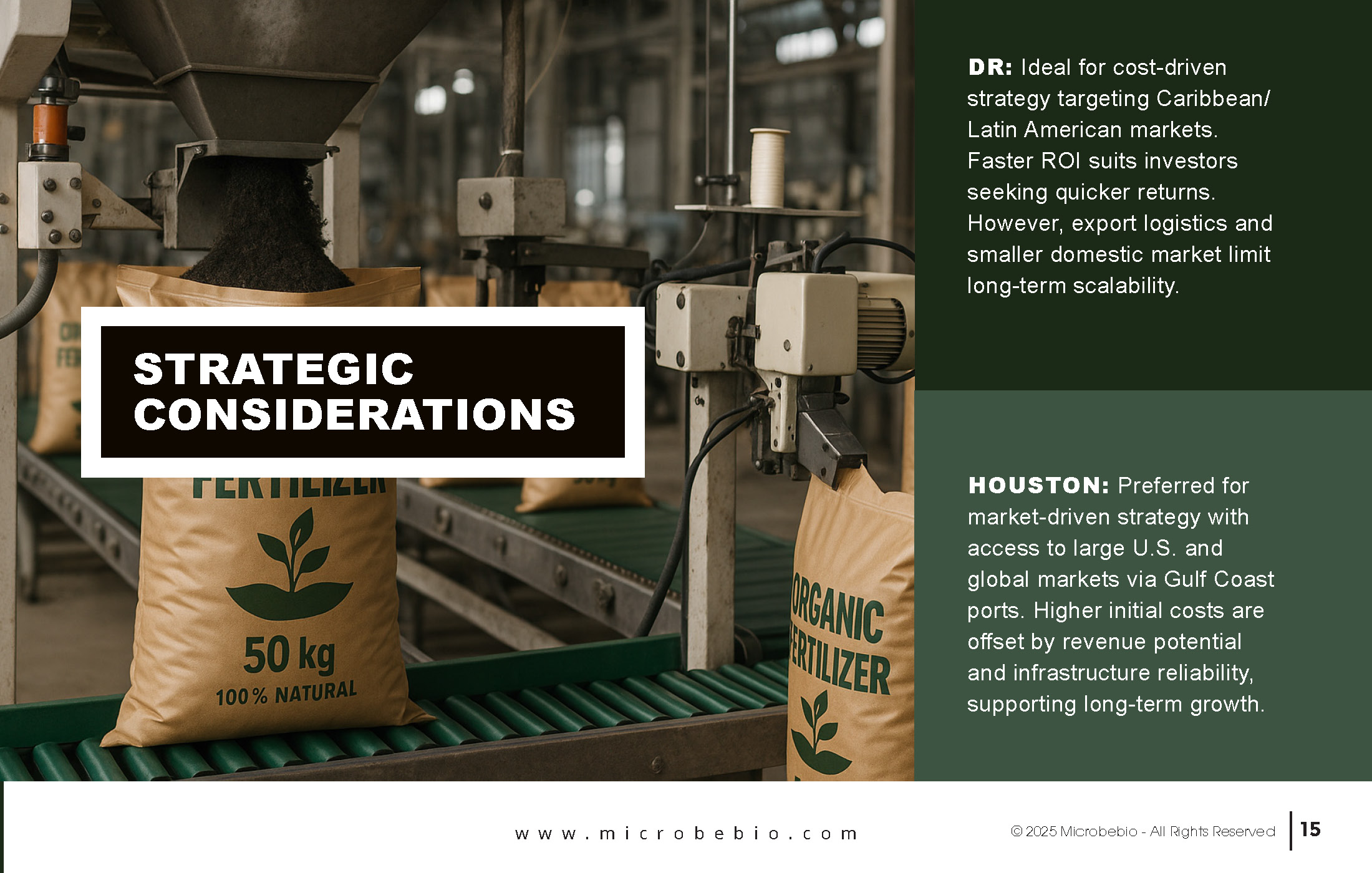

Strategic Considerations

- DR: Ideal for cost-driven strategy targeting Caribbean/Latin American markets. Faster ROI suits investors seeking quicker returns. However, export logistics and smaller domestic market limit long-term scalability.

- Houston: Preferred for market-driven strategy with access to large U.S. and global markets via Gulf Coast ports. Higher initial costs are offset by revenue potential and infrastructure reliability, supporting long-term growth.

Recommendation

- Short-Term (1-5 Years): The Dominican Republic offers a faster ROI (~4.5 years) due to lower CapEx and OpEx, making it attractive for cost-conscious investors or export-focused strategies.

- Long-Term (5-10 Years): Houston is recommended for its larger market, scalability, and infrastructure, ensuring sustained profitability and alignment with Microbebio’s goal of leading sustainable agriculture in North America.